By Manifesto Joe

In the five years since this post first appeared, I've gotten in trouble with the IRS. Looks like I may end up getting an attorney before this is over. Conservatives may laugh, but hey -- if not for your moronic Iraq War, and your giving zillionaires and big corporations a tax pass, perhaps I wouldn't owe so much.

BTW, I didn't post for a few months, but I've been busy with a little thing called life. One week ago I got out of the hospital after surgery and am recovering at home. I finally have a lot of time on my hands, so I'm back on the blog trail.

Without further ado, this is from April 15, 2011:

The Republicans just don't get it, and it looks like they won't in the foreseeable future. With 40 cents of every federal dollar spent now being borrowed, they want to give yet more tax bonanzas to the rich while essentially abolishing Medicare and Medicaid.

This isn't what Americans voted for in 2008. A lower percentage of them, those who bothered to vote in 2010, voted for such folly whether they knew it or not.

The numbers cry out for a tax hike on the wealthy.

When one talks to earners at the upper-middle level, they are quick to point out the marginal rate of 35%, arguing that with progressive tax brackets, many of them end up paying more than lower earners as a percentage. (That's what comes of a steady mental diet of Fox News. That stuff rots brains.)

Yet such people seem to get amnesia when one points out that just 10 or so years ago, when the marginal rate was 39.6%, the U.S. was running a surplus. This was no accident. Even with the modest Clinton tax hike on the rich that barely passed in 1993, we didn't have the structural deficit we have now.

And the Mainstream Media are quick to obfuscate, talking to selected economists who keep telling the victims that raising taxes on the rich won't be enough. And who owns the MSM? Giant corporations -- and how much income tax do they pay?

Two-thirds of corporations pay no income tax

That's not news -- the first of the stories broke in 2008. Here's a link to one of them.

Although it's not news, many people don't seem to "get it," so it bears repeating, and repeating some more. Most of these "legal persons" are getting a free ride. They use the infrastructure (such as it is now), and have vast resources to fleece ordinary, unsuspecting victims out of many billions, yet they pay nothing.

In case you thought I was joking, here's a link to a more recent story about this, courtesy of Alternet.

In their 1990 book America: What Went Wrong?, investigative journalists Donald Barlett and James Steele cited IRS statistics that show that, in 1959, corporations accounted for 39% of federal tax revenue. By 1989, that was down to 17%. And it's probably gotten worse since then.

Here's a brief roll call of Corporate America's tax slackers:

General Electric -- Last month, The New York Times reported that, in addition to paying no federal income taxes this year, GE, the largest U.S. corporation, is to get a tax credit of $3.2 billion. GE made $14.1 billion in profits in 2010, $5.1 billion of which came from its U.S. operations. The story was conspicuously absent from NBC News, part-owned by General Electric.

Goldman Sachs -- Bloomberg News, in December 2008, reported that Goldman Sachs Group Inc., which got $10 billion and debt guarantees from the U.S. government in October, expects to pay $14 million in taxes worldwide for 2008 compared with $6 billion in 2007. The company’s effective income tax rate dropped to 1 percent from 34.1 percent, Goldman Sachs said. The firm reported a $2.3 billion profit for the year after paying $10.9 billion in employee compensation and benefits. U.S. Rep. Lloyd Doggett, a Texas Democrat who serves on the tax-writing House Ways and Means Committee, said steps by Goldman Sachs and other banks shifting income to countries with lower taxes is cause for concern. "This problem is larger than Goldman Sachs," Doggett said. "With the right hand out begging for bailout money, the left is hiding it offshore."

ExxonMobil -- In March 2010, Forbes magazine reported that the oil giant, "which last year reported a record $45.2 billion profit, paid the most taxes of any corporation, but none of it went to the IRS":

Exxon tries to limit the tax pain with the help of 20 wholly owned subsidiaries domiciled in the Bahamas, Bermuda and the Cayman Islands that (legally) shelter the cash flow from operations in the likes of Angola, Azerbaijan and Abu Dhabi. No wonder that of $15 billion in income taxes last year, Exxon paid none of it to Uncle Sam, and has tens of billions in earnings permanently reinvested overseas.

Mother Jones magazine noted that, despite benefiting from corporate welfare in the U.S., Exxon complains about paying high taxes, claiming that it threatens energy innovation research. It was noted at the Wonk Room that big corporations' tax shelter practices similar to Exxon’s shift a $100 billion annual tax burden onto U.S. taxpayers.

This list could grow to tedious proportions. You should get the picture by now.

Let's start sharing some sacrifice

Nobody likes to pay taxes. I owed the IRS far more than I expected to this year, and will probably be until fall paying it all off. But when some common slob like me is paying Uncle Sam more, year after year, than GE is, then there must be something dreadfully wrong with this system.

But alas, our Republican brethren still don't get it. They are promoting the idea of still more tax bonanzas for the wealthy. And, although a corporation enjoys the status of a "legal person" in our psychopathic system, two-thirds of them pay nothing, and even get refunds and billions in corporate welfare on top of that.

The latest news on this was from The Associated Press. It's not just corporations that are the problem. About 45% of U.S. households will pay no income tax at all, thanks to all the breaks that people, especially the super-rich, are getting.

It should be clear, if one looks at the numbers honestly, that our structural deficit has much more to do with what needs to be raised than with what needs to be cut.

Yet, the Republicans persist in their policies of the past 30-plus years, to defecate all over ordinary people while cutting sweet deals for their rich campaign contributors. And the Democrats haven't been very much better. Even President Barack "Change you can believe in" Obama hasn't been nearly candid enough on this issue.

So, what is to be done? Giant corporations and the super-rich clearly have politicians by the balls and have been gaming the system accordingly for the past 30-plus years. What can an ordinary person do?

(1) Stop believing the MSM. They obfuscate, and sometimes outright lie. And that shouldn't be surprising, given that they are generally owned by the very corporations that have been getting a free ride.

(2) Vote in the primaries. This is where people can get real Democrats, not just more corporate lackeys, to be candidates in the general election. The one positive that came out of the 2010 midterm debacle was that now, the Democrats left in Congress are more progressive on these kinds of issues. Ironically, it was largely the "Blue Dogs" and Democrats-in-name-only who went down in defeat to Tea Party challengers.

(3) Vote in the general elections. As frustrating as DINOs can be, and as agonizingly placating as Obama has been, we're better off with them than we are now, with right-wing Republican ideologues writing the agenda. President Clinton, Republicrat though he often was, presided over the last balanced federal budget, and that was largely because he demanded that the rich pay at least a modestly higher percentage of their hefty incomes in taxes. And back then, there was little talk of privatizing Medicare.

(4) General strike. In contemporary America, it will be very hard to float this idea. But if most of the work force in this country were willing to "sick out" just one day, and a few spokespeople made clear to the powers that be that this was an organized protest, it might perk up some ears.

This country is far from broke. The trick is going to be getting the rich slackers who have the bucks to fork some of them over. There are people out there who have it -- but they aren't going to let go of any of it without a fight.

Just pay your taxes today, chumps. Serious training starts tomorrow.

Manifesto Joe Is An Underground Writer Living In Texas.

Showing posts with label IRS. Show all posts

Showing posts with label IRS. Show all posts

Saturday, April 2, 2016

Monday, April 11, 2011

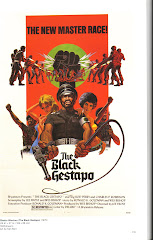

From Joe's Vault: IRS Tax Gestapo Loves To Pick On Poor People

Originally posted in April 2007.

By Manifesto Joe

"... In 1976, my mother owed $300 in taxes. They were not paid due to the fact that she was diagnosed with cancer and given 12 weeks to live. In May, as she lay dying, two IRS agents showed up at my house where we had moved my mother to take care of her. They told me they were friends and had come to visit. I took them to the room, where they introduced themselves as IRS agents and served her papers to confiscate everything she owned. She was to (sic) weak to sign the paper but did make an X and I signed for her. On that day, they took everything she owned ... even the soda bottles at her place of business! She died within the week. ..."

-- IRS Abuse Report #193, from legalminds.lp.findlaw.com

Those were supposed to be the bad old days of the IRS. After countless complaints like this, in the late '90s there was a bid to reform the service into something BusinessWeek called, a bit facetiously, a "kinder, gentler IRS." The Internal Revenue Service Restructuring and Reform Act of 1998, signed by President Clinton, was gauged to make "significant structural changes in the management and oversight ..." and strengthen and enhance "the rights of and protections applicable to taxpayers ..."

There were a few meaningful changes in the new law. But it didn't take long for the IRS to revert to stonefaced abuse of poor and financially distressed taxpayers -- while ignoring most of the cheating by the rich.

Under the Bush regime, the working poor have come under special attack over their claims of the Earned Income Credit. This is an especially valuable tax credit for people coming off the welfare rolls and into the low-wage job market, because it can bring a refund of all income tax and Social Security tax withheld from their paychecks. The bottom line: This credit is an incentive for welfare recipients to go to work. Wasn't that what the Right-Wingers wanted when they "reformed" welfare in 1996?

But, being a conservative means never having to say you're sorry. In the conservative world, the poor are a sub-species, basically faceless and worthless. If people are poor, then they must be lazy, drink too much and gamble, rent their kids to pedophiles, or such. It most certainly has to be their fault; and if you honestly try to help them, I'm told that they'll spend the money on a console and play Nintendo all day. So, as the thinking on the Right goes, we might as well kick this sort of gutter trash around a whole lot more.

So, this is where the IRS comes in. David Cay Johnson reported in this story, first published by the New York Times on Jan. 10, 2006, that:

Tax refunds sought by hundreds of thousands of poor Americans have been frozen and their returns labeled fraudulent, blocking refunds for years to come, the Internal Revenue Service's taxpayer advocate told Congress today.

The taxpayers, whose average income was $13,000, were not told that they were suspected of fraud, the advocate said in her annual report to Congress. The advocate, Nina Olson, said her staff sampled suspected returns and found that, at most, one in five was questionable.

A computer program selected the returns as part of the questionable refund program run by the criminal investigation division of the Internal Revenue Service. In some cases, the criminal division ordered that taxpayers be given no hint that they were suspected of fraud, the report said.

Most of the poor people whose returns the computer flagged as fraudulent were seeking the earned income tax credit, a benefit for the working poor. The credit can return all of the income taxes and Social Security taxes withheld from the paychecks of poor people. Without the credit, many poor people coming off welfare and going to work would receive less money because of taxes taken out of their paychecks and the loss of health benefits, I.R.S. data and other government documents show.

The average refund sought was $3,500, which under the rules for obtaining the credit means that the vast majority of those suspected of fraud were single parents or married couples with children. The maximum benefit for singles is less than $400.

Ms. Olson said the I.R.S. devoted vastly more resources to pursing questionable refunds by the poor, which she said cannot involve more than $9 billion, than to a $100 billion problem with unreported incomes from small businesses that deal only in cash, many of which do not even file tax returns.

Let's forget any discussion of "small" businesses here. And, going into the way the rich and corporate giants get by without paying taxes is a whole different post. There isn't nearly enough room here.

Suffice it to say that some of us know what this is about, from schoolyard memories. It's a lot easier to pick on little kids than to take on the big ones. The IRS is just one of many bully magnets in our society. I haven't got time or space to describe all the others. It is merely one manifestation of a rising bully culture. And conservatives seem to be leading the swagger.

Manifesto Joe Is An Underground Writer Living In Texas.

Tuesday, April 15, 2008

More Evidence: IRS Bullies Pick On Little Folks, Let Fatcats Skate

By Manifesto Joe

OK, it's April 15, so a skewering of the IRS is de rigueur. And The New York Times has furnished just the skewer for the job.

NYT reports that, according to a new study, big corporations have less to fear from the IRS than at any time in the past 20 years. The study was released Sunday by Transactional Records Access Clearinghouse (TRAC), a research group affiliated with Syracuse University.

The study cited "a historic collapse in audits" of Corporate America. And it wouldn't surprise me if there are some unofficial Bush administration policies lurking in the woodpile.

According to The Times:

It found that major corporations -- defined as those with assets of at least $250 million -- have about a 1-in-4 chance of being audited, down from about 3 in 4 in 1990.

In contrast, audits of smaller businesses, defined as those with between $10 million and $50 million in assets, increased from 12.3% in 2005 to 15% in 2007. The comparable figures for increasingly larger corporations went like this:

-- $50 million to $100 million in assets, 16.4% in 2005, 11.4% in 2007.

-- $100 million to $250 million, 17.5% in 2005, 12.1% in 2007.

Detect a pattern here? Some in the tax profession do. Again from The Times:

The IRS focus on smaller companies upset some tax professionals. "I'm still trying to find my jaw on the ground from the finding that audit rates for the big boys are plummeting," said Dean Zerbe, managing director of Alliant Group, a tax planning company.

What does the IRS have to say about this, considering all their tough talk about enforcement in recent years? The Times, again:

... IRS officials ... said Friday that TRAC had misinterpreted a basic shift in corporate America in recent years, saying that companies of all sizes -- and some wealthy individuals -- have embraced the use of partnerships and other opaque entities in an effort to minimize taxes.

I just checked, and my wallet is still in my back pocket.

If you've had the experience of dealing with the IRS as a little fish, you know that the fillet knife is usually wielded to scale. The big fish are much harder to handle, and the trend seems to reflect this.

And, given the Gilded Age, robber-baron sensibilities that our executive branch of government has exhibited for seven-plus years, perhaps it shouldn't be surprising that the IRS has changed its focus in this way.

Congress investigates a lot of things, and the IRS has been called on the carpet in the past over other abuses. Maybe it's time for our intrepid reps to find out why, when audit time comes, the tax Gestapo now tends to bully smaller companies while turning a blind eye to Cayman Islands tax dodgers. Inquiring minds should want to know.

For more on the subject, here's a link to my post from last April.

Manifesto Joe Is An Underground Writer Living In Texas.

OK, it's April 15, so a skewering of the IRS is de rigueur. And The New York Times has furnished just the skewer for the job.

NYT reports that, according to a new study, big corporations have less to fear from the IRS than at any time in the past 20 years. The study was released Sunday by Transactional Records Access Clearinghouse (TRAC), a research group affiliated with Syracuse University.

The study cited "a historic collapse in audits" of Corporate America. And it wouldn't surprise me if there are some unofficial Bush administration policies lurking in the woodpile.

According to The Times:

It found that major corporations -- defined as those with assets of at least $250 million -- have about a 1-in-4 chance of being audited, down from about 3 in 4 in 1990.

In contrast, audits of smaller businesses, defined as those with between $10 million and $50 million in assets, increased from 12.3% in 2005 to 15% in 2007. The comparable figures for increasingly larger corporations went like this:

-- $50 million to $100 million in assets, 16.4% in 2005, 11.4% in 2007.

-- $100 million to $250 million, 17.5% in 2005, 12.1% in 2007.

Detect a pattern here? Some in the tax profession do. Again from The Times:

The IRS focus on smaller companies upset some tax professionals. "I'm still trying to find my jaw on the ground from the finding that audit rates for the big boys are plummeting," said Dean Zerbe, managing director of Alliant Group, a tax planning company.

What does the IRS have to say about this, considering all their tough talk about enforcement in recent years? The Times, again:

... IRS officials ... said Friday that TRAC had misinterpreted a basic shift in corporate America in recent years, saying that companies of all sizes -- and some wealthy individuals -- have embraced the use of partnerships and other opaque entities in an effort to minimize taxes.

I just checked, and my wallet is still in my back pocket.

If you've had the experience of dealing with the IRS as a little fish, you know that the fillet knife is usually wielded to scale. The big fish are much harder to handle, and the trend seems to reflect this.

And, given the Gilded Age, robber-baron sensibilities that our executive branch of government has exhibited for seven-plus years, perhaps it shouldn't be surprising that the IRS has changed its focus in this way.

Congress investigates a lot of things, and the IRS has been called on the carpet in the past over other abuses. Maybe it's time for our intrepid reps to find out why, when audit time comes, the tax Gestapo now tends to bully smaller companies while turning a blind eye to Cayman Islands tax dodgers. Inquiring minds should want to know.

For more on the subject, here's a link to my post from last April.

Manifesto Joe Is An Underground Writer Living In Texas.

Subscribe to:

Posts (Atom)